DISCOVER THE

CAPE VERDE ISLANDS!

To travel is to live!

On your holiday in Cape Verde, you’ll experience unforgettable moments day after day. Be enchanted by the sea, the beaches, the green valleys, the mountains, the volcanoes and the warmth and hospitality of the people! Such diversity gives the archipelago in the Atlantic Ocean the status of an insider tip.

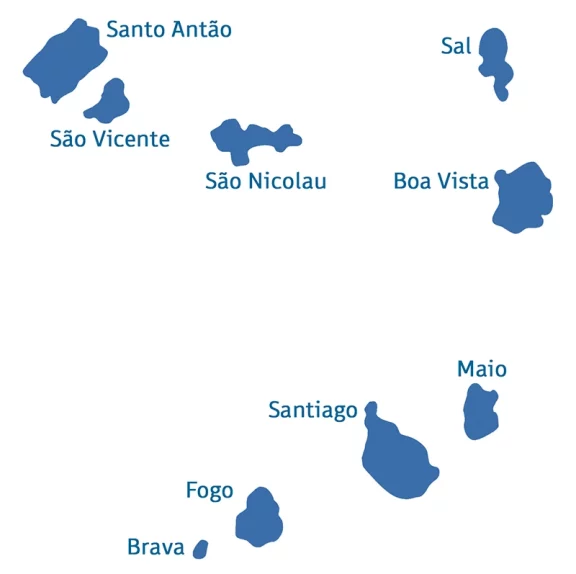

At a distance of 1,500 kilometres south of the Canary Islands and 570 kilometres from the African mainland, the nine inhabited islands offer all the facets that would make your holiday unforgettable.

WHAT DO THE CAPE VERDE ISLANDS HAVE TO OFFER FOR YOUR HOLIDAY?

You’re guaranteed to have a Cape Verde holiday that is as individual as you are. Because it is you alone who directs. There is a cornucopia of possibilities at your disposal. Rather than having to decide whether you prefer the mountains or the sea, or whether you would rather relax or experience adventure, the Cape Verde Islands have all this and much more in store for you.

Go hiking and lie on the beach, live the Creole motto “Cabo Verde – No Stress” in the cosy restaurants in the evenings and let your soul dangle the next day.

Its unique liaison of endless beaches and bustling towns, breathtaking mountains and tranquil villages, misted plateaus and barren landscapes puts you in a position to choose freely. For an ideal beach holiday in Cape Verde, try the islands of Sal, Boa Vista and Maio. There you can go kitesurfing, windsurfing, surfing, diving and fishing, for example. Or you can relax in one of the fantastic beach hotels and all-inclusive resorts along the kilometre-long beaches. But if you prefer an individual round trip or an individual hiking tour, the islands of Santo Antão, Santiago and Fogo are ideal.

WHEN IS THE BEST TIME TO VISIT CAPE VERDE?

Being in Cape Verde is the season all year round. Look forward to 23 to 30 degrees Celsius during the day and about 24 degrees Celsius on summer nights or around 18 degrees Celsius on winter evenings. Even the water is pleasantly warm with 22 degrees Celsius (February/March) to 27 degrees Celsius (September/October). To summarise: the Cape Verde Islands are ideal as a year-round travel destination. Be aware of the time of the winds (Tempo das brisas) on the flat islands from October to July, from which especially surfers and kite surfers benefit, and the rainy season (Tempo das chuvas) in August and September.